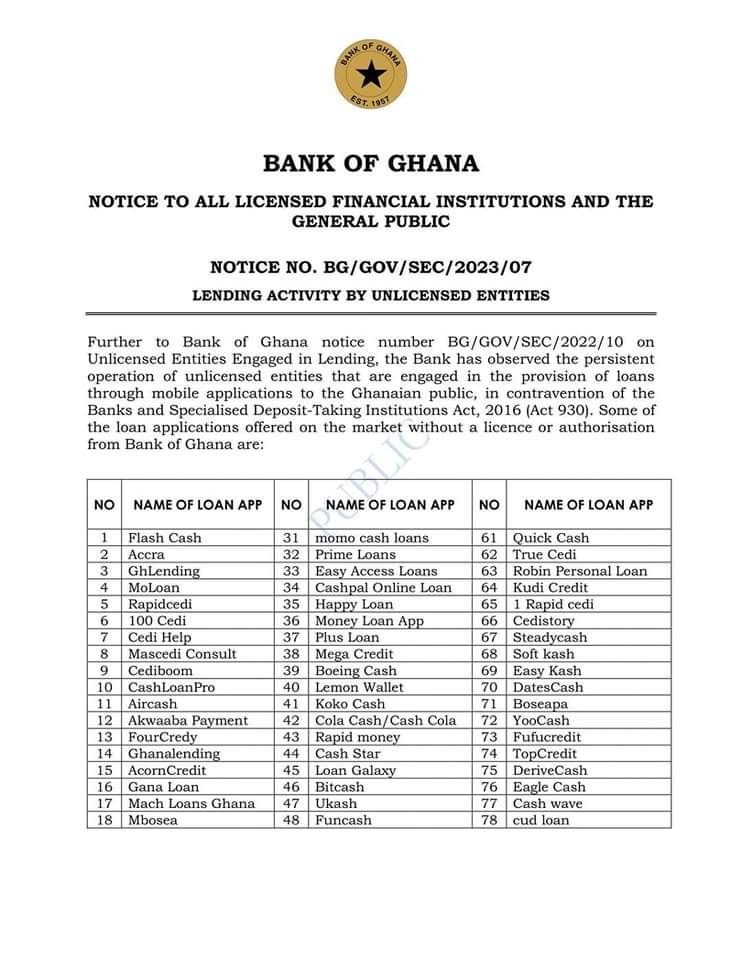

BoG Exposes 97 Unauthorised Lending Apps

The Bank of Ghana has published the names of 97 mobile lending entities which are not licensed or authorised to operate in the country.

The entities provide loans to people through mobile apps, it said.

This come after the persistent operation of such entities despite the Bank’s flagging of 19 of such apps in August 2022.

It notes that their operation contravenes the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930).

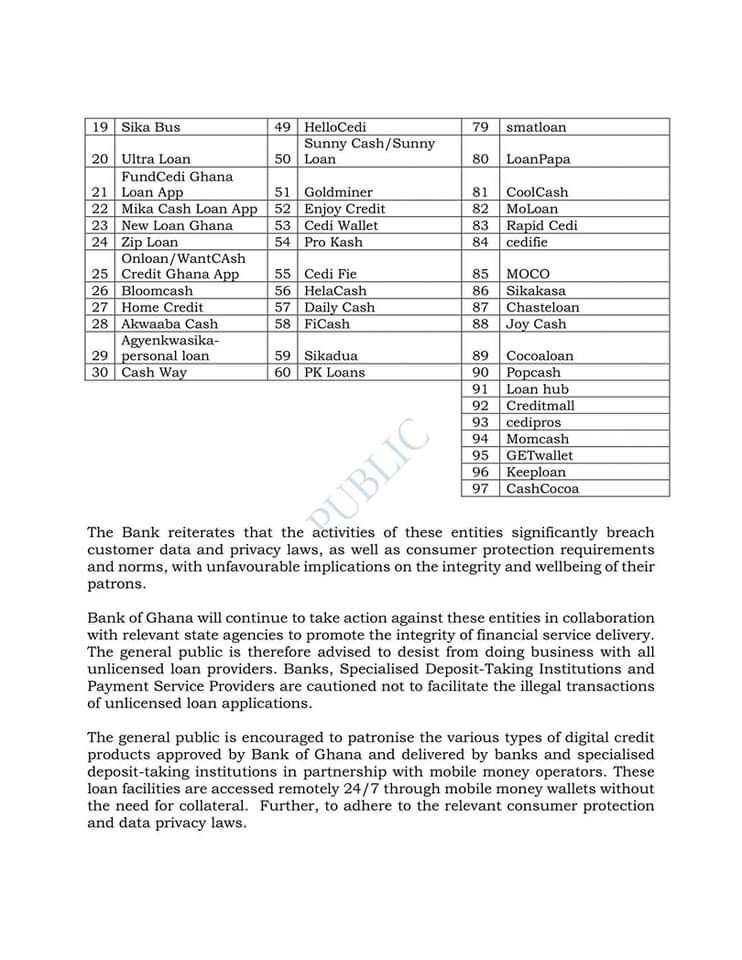

Some of the applications include Flash Cash, 100 Cedi, Cedi Help, Ghanalending, Mbosea, Fufucredit, DatesCash, Easy Kash, Cash Wave, Aircash, Akwaaba Payment, GETwallet, CoolCash, Cedi Fie, Gold Miner, etc.

The BoG said it will continue to take action against these entities in collaboration with relevant state agencies to promote the integrity of financial service delivery.

“The Bank reiterates that the activities of these entities significantly breach customer data and privacy laws, as well as consumer protection requirements and norms, with unfavourable implications on the integrity and wellbeing of their patrons,” a statement from the Central Bank said.

Cautioning the public against transacting with these entities, the Bank said, “The general public is encouraged to patronise the various types of digital credit products approved by Bank of Ghana and delivered by banks and specialised deposit-taking institutions in partnership with mobile money operators. These loan facilities are accessed remotely 24/7 through mobile money wallets without the need for collateral.”

It also warned Banks, Specialised Deposit-Taking Institutions and Payment Service Providers against facilitating the illegal transactions of unlicensed loan applications.