Ghana Lost Over ¢1 Billion Due To Irregularities In 2021

The Auditor General’s 2021 audit report on Ministries, Departments and other Agencies has revealed Ghana lost GH¢1,080,913,824 as a result of financial weakness and irregularities.

The irregularities represent either losses that had been incurred by the State through the impropriety or lack of probity in the actions and decisions of public officers or on the other hand, the savings that could have been made if public officials and Institutions had duly observed the public financial management framework put in place to guide their conduct and also safeguard national assets and resources.

Irregularities in 2021, according to figures put out by the auditor General, reduced compared to preceeding years.

In 2017 the country recorded 892,396,375.19 in regularities; GHC5,196,043,399.94 in 2018; GHC3,008,187,888.15 in 2019; and GHC2,053,176,449.85 in 2020.

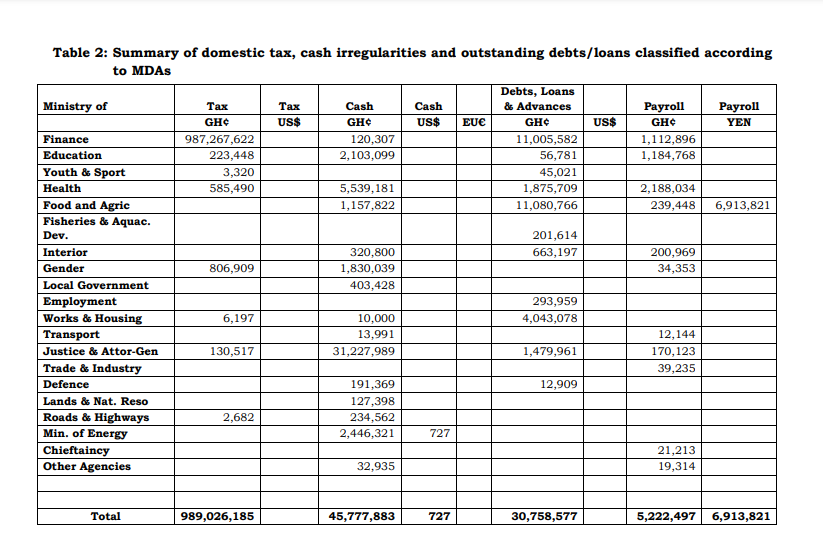

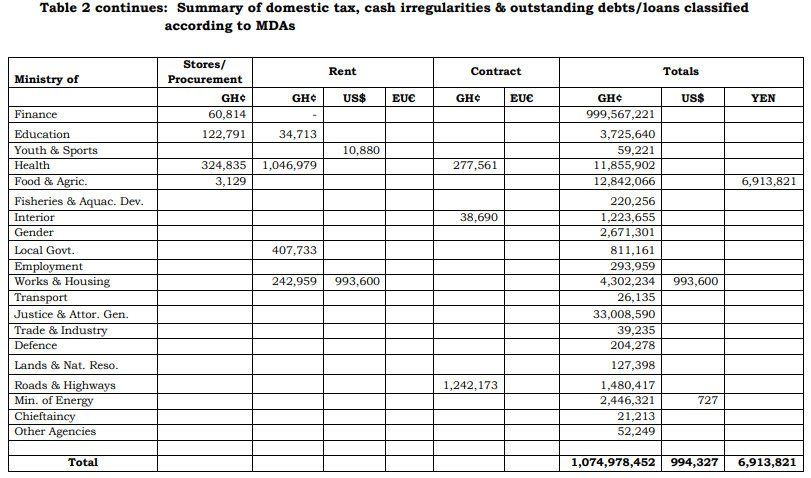

In 2021, GHC 989,026,225 tax irregularities; GHC 45,763,607 Cash irregularities; GHc30,758,576 debt; loan and advances irregularities; GHC5,601,611 payroll irregularities; GHc511,569 stores and procurement irregularities; GHc7,710,925 rent irregularities; and GHC 1,559,424 contract irregularities were recorded according to the AG.

Tax Irregularities

The AG found that tax irregularities accounted for 91.5% of financial infractions recorded in 2021.

It found that the country lost GH¢402,804572 in tax due to the failure of 28 Oil Marketing companies (OMCs) to pay their rescheduled debt between January 2021 to December 2021.

“These irregularities could be attributed mainly to failure on the part of the Ghana Revenue Authority to pursue the OMCs by applying the relevant measures and sanctions against defaulters.”

Cash Irregularities

Total cash irregularities noted during the period amounted to GH¢45,763,607 which represented 4.23% of the total irregularities, the AG reports.

This cut across Ministries, Departments and Agencies (MDAs), it noted.

The irregularities were found in Unapproved disbursements; Unpresented payment vouchers; Unaccounted revenue; Unsupported payment vouchers; Funds to the bank not credited; Non-lodgement of public funds; Misapplication of funds; and Unretired Imprest.

“Included in the total cash irregularity of GH¢45,763,607 was an amount of GH¢2,446,321.48 and USD 727.00 paid on 14 payment vouchers but were not presented for examination during the reviewed period.

“In the absence of the payment vouchers and supporting documents, we recommended that the Chief Director and the Head of Finance should pay back into account the amount involved.”

Indebtedness/Loans/Advances

This accounts for 2.8% of the total irregularities.

The reports noted that GH¢9,521,00.00 of the amount was owed by 62 companies and individuals to the Ministry of Food and Agriculture for the purchase of Tractors.

The Auditor General has therefore recommended that the Chief Director and the Director of Engineering should recover the outstanding debt from the defaulting companies and individuals with interest at the prevailing Bank of Ghana interest rate.

Payroll Irregularities

The Auditor General found that unearned salaries totalling GH¢1,501,740.00 were paid to 146 officers of 47 Institutions under the Ministry of Health.

He recommended that the total amount must be recovered by the Heads of the various Institutions to the Government chest without delay.

Stores/Procurement Irregularities

The AG said that Stores and procurement irregularities noted during the audit period included GH¢108,552.00 relating to the purchase of educational items through the sector Minister’s share of the GETFund.

The items which included laptops, mathematical sets, exercise books, and nose masks were procured from two suppliers by the Ghana Education Service, Akropong – Akuapem, which were not accounted for.

“The irregularity was due to the direct supply of the items to the MP’s office without available records on the items at the Municipal Education Office before distribution was carried out.

“We recommended that the Member of Parliament should account for the items worth GH¢108,552.00, failing which he should refund the money.”

Rent Irregularities

Rent irregularities include GH¢600,013.00 due from government workers from 13 Health Institutions who defaulted in the payment of rent and US$993,600.00 due government from 48 occupants of the United Nations Development Programme (UNDP) flats.

The AG found that the loss was due to the ineffectiveness of Management in the collection of rent from the occupants.

“We recommended recovery of the rent from the operatives of National Security and the other tenants, failing which they should be ejected from the flats”, the report said.

Contract Irregularities

This included GH¢1,188,816.00 which was an interest paid on delayed payments for contract certificates raised.

“We recommended that the Minister for Roads and Highways should investigate the cause of the interest payment and ensure that those found culpable are made to refund the interest paid.”

Below are summaries of irregularities recorded in various Ministries, Departments and Agencies (MDAs):

Source: opemsuo.com/Hajara Fuseini